missouri gas tax refund

SB 635 - Riddle - Provides that a person who is injured by a product has 15 years after the sale or lease of the product to bring a suit for damages. Mike Parson called for a special session Monday and will ask the state legislature to extend key agricultural tax credit programs and reduce the states income tax.

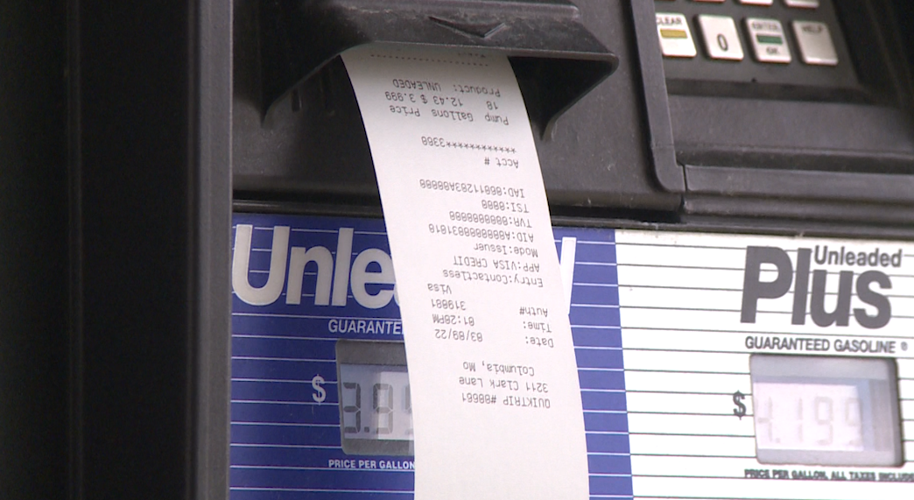

Save Your Receipts Missourians Can Apply For Refund On State Gas Tax Increase Later This Year

The first increment increase happened Oct.

. The Missouri Department of Revenue said as of July 15 theyve received 3175 gas tax refund claims and have some tips for those preparing to file. Workers who earn between 100000 and 200000 are in line for 100. SB 636 - Onder - Creates new provisions prohibiting employers from imposing.

To search type in a keyword andor choose a category. Louis holds land tax sales at the Civil Courts building downtown where properties are up for sale due to owners not paying property taxes for four years. Missouri has combined state and local sales tax rates that are higher than the national average and property taxes that are below the national average.

NoMOGasTax App is built to calculate the key data points for to file the MO4923h form for highway vehicles. Every time you get gas in the state of Missouri you might be due for a refund Upload your gas receipts and enter the key details the State of Missouri requires for a refund from the Department of Revenue. -- Stoked by the largest surplus in state history Missouris Republican-led Legislature devised a 500 million plan to send one-time tax refunds to millions of households.

Since the gas tax was increased in October from 17 cents to 195 this year people will be able to claim 25 cents on each gallon of gas bought in Missouri over the past nine months. Vehicle and Fuel Information Signature Title Printed Name Date MMDDYYYY Under penalties of perjury I declare that the above information and any attached supplement is true complete and correct. If you are a renter and permanent resident of another state.

In Missouri income from retirement accounts such as an IRA or 401k is taxed as regular income though some exemptions are available. Skip Navigation Share on Facebook. Those making less than 100000 annually will receive a 300 rebate.

Stoked by the largest surplus in state history Missouris Republican-led Legislature devised a 500 million plan to send one-time tax refunds to millions of households. Missouri is increasing the state gas tax 25 cents every year for the next few years until the gas tax reaches about 30 cents a gallon. Ims for Missouri motor fuel tax paid on fuel purchased for non-highway use must continue to be filed using Non-Highway Use Motor Fuel Refund Claim Form 4923.

Eggleston of Maysville the tax refund only applies to gas purchased in Missouri from October 1 st 2021 to June 30 th 2022. The first of five annual gas tax increases of 25 cents per gallon takes effect reaching a total increase of 125 cents by 2025. Overview of Missouri Retirement Tax Friendliness.

1 2021 and the. Motorists across Missouri will start seeing higher gas prices Friday. Get your 5 Cents Gas Tax Cash Back.

Missouri drivers are eligible for a refund on every gallon of gas purchased. Thousands of Hawaii residents are set to get a one-time tax refund that will start going out at the end of this month. Regular Property Tax Refund Income Requirements If you are and You may qualify for a refund of up to A renter Your total household income is less than 64920 2280 A homeowner Your total household income is less than 119790 2930 Other Requirements If you were a part-year resident of Minnesota during 2021.

Modifies provisions relating to Missouri Local Government Employees Retirement System in order to provide for coverage of certain employee classes. Democratic lawmakers had argued the tax refund would only benefit middle-income families because the poorest workers dont pay income taxes and that not enough money was set aside to provide the. With the passage of Senate Bill 262 the Missouri Department of Revenue made changes to some of the forms used when requesting a refund of taxes paid on Missouri motor fuel used for non-highway purposesPlease refer to the Motor Fuel Tax Non-Highway Form Updates for more information.

According to Hawaiis Department of Taxation the refunds are expected to start going out during the last. JEFFERSON CITY Mo. According to State Representatives Randy Railsback of Hamilton and J.

The City of St.

Money Tax Deductions Tax Help Tax

Thousands File Gas Tax Refund Claims With Missouri Department Of Revenue Youtube

Gas Tax Cut Again In Missouri Nextstl

/cloudfront-us-east-1.images.arcpublishing.com/gray/UVKDIY5245HFXDFVABZAPRJRFY.bmp)

Missouri Residents Can Get Money Back Through Gas Tax Refund

Pin On Best Of Simple Life Of A Country Wife

W 11 Form Completed How I Successfully Organized My Very Own W 11 Form Completed Form Example Job Application Template Standard Form Math

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Home Heating Tax Credit Utility Bill Payment Tax Credits Michigan

Missouri Drivers Are Now Eligible To Start Filing For Their Gas Tax Refunds With The State Of Missouri Via The Nomogastax App

Missouri Department Of Revenue Plans To Offer Money Back On Gas Purchases Koam

W 11 Form Completed How I Successfully Organized My Very Own W 11 Form Completed Form Example Job Application Template Standard Form Math

Digital Marketer Ui Ux Designer Growth Hacker Ruslan Galba

Gas Tax Brass Tacks What Drove Missouri S First Fuel Tax Increase In 25 Years News Columbiamissourian Com

The Credit Wellness Checklist Everyone Needs To Use Checklist Lexington Law Finances Money

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

2400 Update Two Major Raises For Social Security Ssi Ssdi Stimulus Pa In 2022 Stock Market Tax Refund Daily News